jersey city property tax rates

And while the average property tax bill in the state and. The tax rate is set and certified by the Hudson County Board of Taxation.

States With Highest And Lowest Sales Tax Rates

Property Tax Appraisals The City of Jersey City Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood.

. 11 rows City of Jersey City. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 621 7 717 7 7 5171 7 81 252 81 967 73. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

2021 General Tax Rate 2020 Average Tax Bill. The average effective property tax rate in New Jersey is 242 compared with a national average of 107. Office of Administrative Law OAL Office of Diversity and Inclusion.

The assessed value is determined by the Tax Assessor. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. 217500 jersey city property tax rate tax paid.

It is equal to 10. The average effective property tax rate in new jersey is 242 compared with a national average of 107. The City of Jersey City assessors office can help you with many of your property tax related issues including.

Lawsuit Alleges Developer of NJs Tallest Building is Defrauding Condo Purchasers 124 Residences Event Space and New School Planned for Jersey Citys Sacred Heart Site Jersey Citys Broa Moving to Historic House on Grove Street. I fully expect our local property tax rate to hit 21 - 22 percent within five years. NJ Economic Development Authority.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. In any case in a state where the average municipal tax rate is 24 and where only a tiny amount of towns have a tax rate lower than ours it is inevitable that our rate will continue to go up. 217500 median tax paid.

When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400. 587 rows The General Tax Rate is used to calculate the tax assessed on a property. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

In New Jersey localities can give. Online Inquiry Payment. The property tax rate is 4548 for each 1000 of assessed value.

Division of Rate Counsel. The amount of property tax owed depends on the appraised fair market. The referendum which was voted on Tuesday along with a statewide decision about legalizing Marijuana received support from 64 percent of voters according to the New York Times.

Property tax rates are the rate used to determine how much property tax you pay based on the assessed value of your property. New Jerseys highest-in-the-nation average property tax bill hit 9112 last year. 252 551721 252 05 252 51 252.

Dont let the high property taxes scare you away from buying a home in New Jersey. Jersey City as well as every other in-county public taxing unit can at this point calculate needed tax rates since market worth totals have been determined. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Then are the prime determinants of each taxpayer s burden lot identifiers 8875 sales. Office of the Public Defender OPD State Capitol Joint Management Commission. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

New Jersey Building Authority NJBA New Jersey Public Broadcasting Authority. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. General Tax Rates by County and Municipality.

A salary of 50000 in jersey city new jersey could decrease to 31269 in maumelle arkansas assumptions include homeowner no child care and taxes are. When summed up the property tax burden all owners bear is created. Condos are a bit different than owning the whole property as an individual.

Jersey city property tax rate 2020. Voters in Jersey City have endorse new Property Tax design to fund the arts offering a boost to industry with many now out of work. To pay for the City of Trenton Property taxes online you will need either your account number or the propertys block lot and Qualification if applicable and the owners last name.

The information displayed on this website is pulled from recent census reports and other public information sources. New Jersey New Hampshire Illinois have highest property tax rates National. So its primarily just budgeting first establishing a yearly expenditure level.

Neighborhood in Jersey City property tax rates Jersey property tax rate BAYONNE CITY8458 3073 is one of highest. Because we did a city wide reval you shouldnt expect much deviation from the 14800 you mentioned. The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119.

They can be all over the board. Dont quote me but I believe that they judge the value in comparison to comparable properties then you pay tax on the assessment. New Jersey Tax Court on January 31 2020 for use in Tax Year 2020 2019 Table of Equalized Valuations for all of New Jersey Certified October 1 2018 for use in.

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Here S The Average Property Tax Bill In Belleville Nutley Belleville Nj Patch

State Corporate Income Tax Rates And Brackets Tax Foundation

Township Of Nutley New Jersey Property Tax Calculator

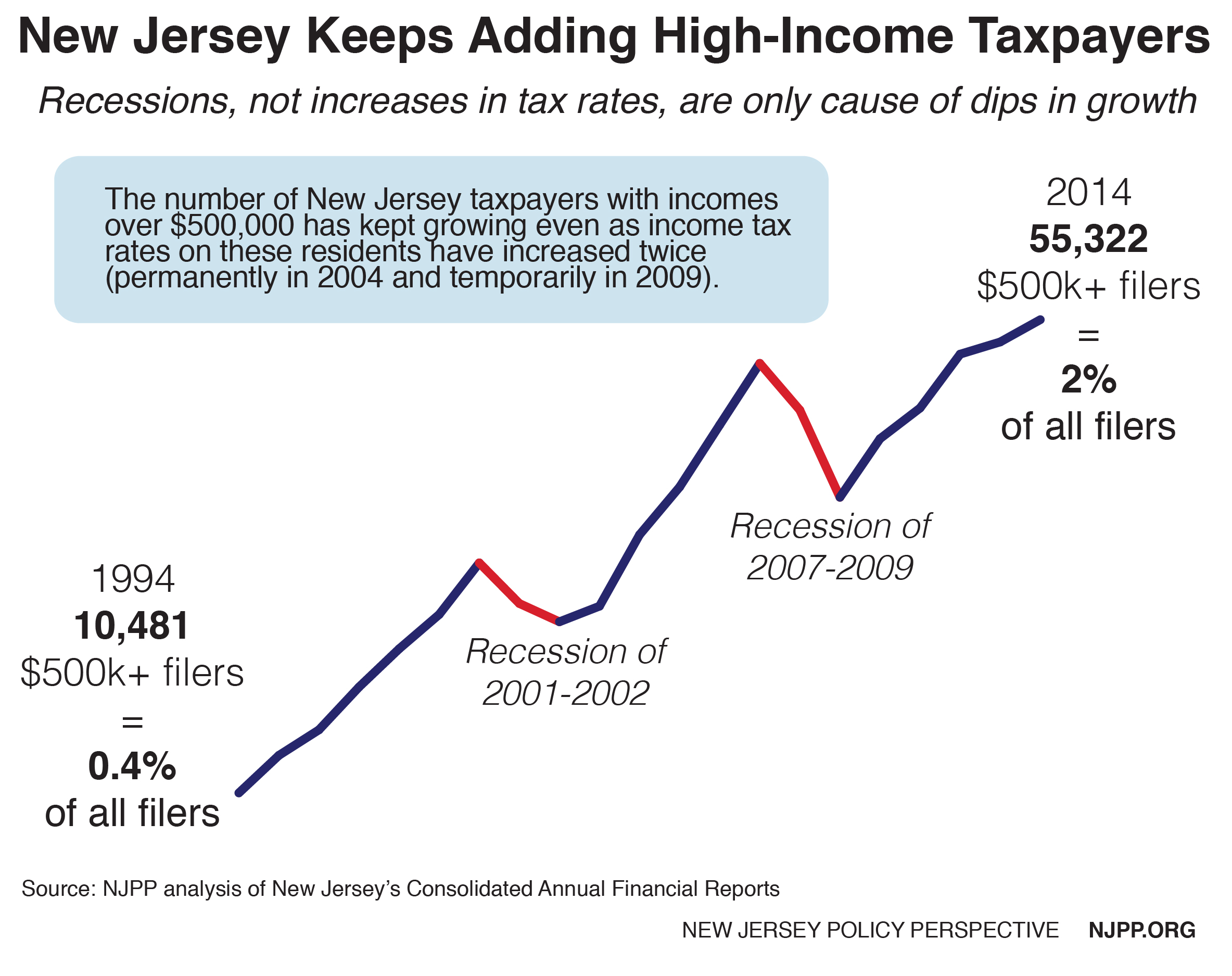

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

How Do State And Local Corporate Income Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Freehold Township Sample Tax Bill And Explanation

How Do State And Local Individual Income Taxes Work Tax Policy Center

New York Property Tax Calculator 2020 Empire Center For Public Policy

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

States With The Highest And Lowest Property Taxes Property Tax High Low States

Property Taxes How Much Are They In Different States Across The Us

New Jersey Sales Tax Small Business Guide Truic